The US & Ukraine have signed a deal that will give Washington access to some of the war-torn country’s natural resources. It sets up an investment fund that Ukraine hopes will cement US assistance as the country struggles to repel Russia three years after the invasion.

Trump has previously demanded that Ukraine pay back the $350bn (£264bn) of aid that he claims has been provided by the US during the war – a condition that Ukraine’s President Volodymyr Zelensky rejected.

Ukrainian Prime Minister Denys Shmyhal said the agreement did not dictate that his country pay back any supposed “debt”. Trump has styled the agreement as a win for his side as well, saying his country will get back “much more in theory” than the billions that were provided to Ukraine by his predecessor Joe Biden.

The agreement refers to “Russia’s full-scale invasion” and the US Treasury Department adds that “no state or person who financed or supplied the Russian war machine will be allowed to benefit from the reconstruction of Ukraine”.

The agreement designates the U.S. International Development Finance Corporation (DFC) as the U.S. partner in the deal.

WHAT’S THE DEAL?

- The mineral deal will create a U.S. controlled investment fund that would receive revenue from Ukraine’s natural resources

- Ukraine managed to get some of what it wanted, but not everything.

- White House demanded Ukraine to repay assistance given during the war with its mineral wealth .

- The idea of treating that aid as debt was removed in the final deal.

- The door kept open for Ukraine to eventually join the European Union.

- There was no mention of a U.S. security guarantee in the text of the nine-page deal

- Kyiv & Washington will jointly manage the fund, which will be financed with revenues from new projects in critical minerals, oil and gas — not from projects that are already operating.

- Although the agreement does not treat past aid to Ukraine as debt that the country needs to repay, it does say that future military aid, including weapons and training, will be treated as a U.S. contribution to the fund — meaning that Ukraine will need to match future aid with resource wealth.

- The agreement does not change the management of Ukraine’s state-owned energy companies.

- All natural resources will still be considered Ukraine’s property.

- The agreement says that the United States and Ukraine want to ensure that countries “that have acted adversely to Ukraine in the conflict do not benefit from the reconstruction of Ukraine”

- Ukraine’s parliament still has to ratify the agreement.

- Ukraine was demanding post-war support & security guarantees.

- Without those guarantees, Ukraine said, Russia could quickly violate any cease-fire or restart the war

In all cases, the resources stay in Ukrainian ownership, even though the US will get joint access.The inclusion of oil and gas has been seen as a softening of the Ukrainian position, since they were not in earlier drafts of the deal.

Ukraine has long aspired to join the European Union and accession talks formally began last June. There were some concerns in Kyiv that the resources deal could hinder Ukraine’s ability to join the EU, if it gave preferential treatment to US investors, as Kyiv and Brussels already have a strategic partnership on raw materials.

But the deal’s text says that the US acknowledges Ukraine’s intention to join the EU and the need for this agreement not to conflict with that.

It also says that if Ukraine needs to revisit the terms of the deal because of “additional obligations” as part of joining the EU, then the US agrees to negotiate in good faith. Additionally, Kyiv says the US will support additional transfers of investment and technology in Ukraine, including from the EU and elsewhere.

The US has framed the deal as an essential one to sign if Ukraine is to continue to receive its military assistance. Ukrainian First Deputy Prime Minister Yulia Svyrydenko – who flew to Washington DC to sign the deal – said it envisaged the US contributing new assistance in the future, such as air defence systems.

This, too, would mark a change in strategy for Trump – who has sought to wind down military support for Ukraine since returning to the White House. One outstanding question is what the accord will ultimately mean for the state of the war. The Kremlin has not yet responded to the agreement.

It appears there are no concrete security guarantees from the US, which is something Ukraine and Europe have long been pushing the White House to provide. Trump has long been reluctant to give the same military commitment that Biden had given.

Instead, his interest in staying the course with US support for Ukraine is more implicit, due to the economic commitments set out in this deal. That means there would still be a fragility about the commitment of Ukraine’s most important ally.

One intriguing point highlighted by Ukraine’s government is that for the first decade of the reconstruction investment fund, profits will be “fully reinvested in Ukraine’s economy“, either in new projects or reconstruction. This could be potentially significant if there is no financial benefit for the US for 10 years.

However, this provision does not appear to be in the agreement signed in Washington, although it might later be part of an additional “technical” deal. Deputy Prime Minister Yulia Svyrydenko said on social media that “these terms will be subject to further discussion”.

After that initial 10-year period, Kyiv says profits may be distributed between the partners. US treasury Secretary Scott Bessent said that the deal was a signal to the American people that “we have a chance to participate, get some of the funding and the weapons, compensation for those and be partners with the success of the Ukraine people”.

WHAT MINERALS DOES UKRAINE HAVE?

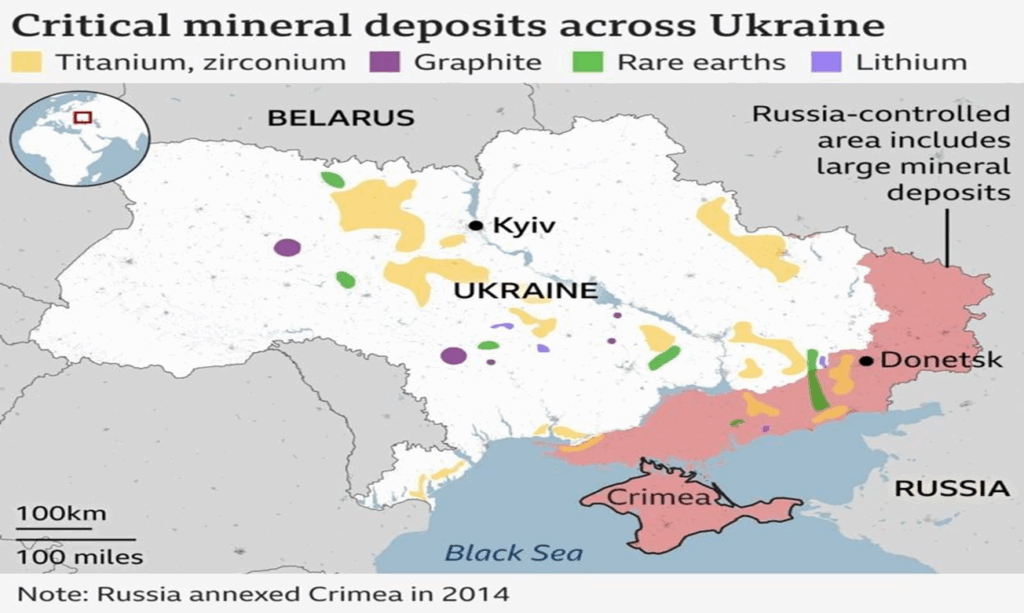

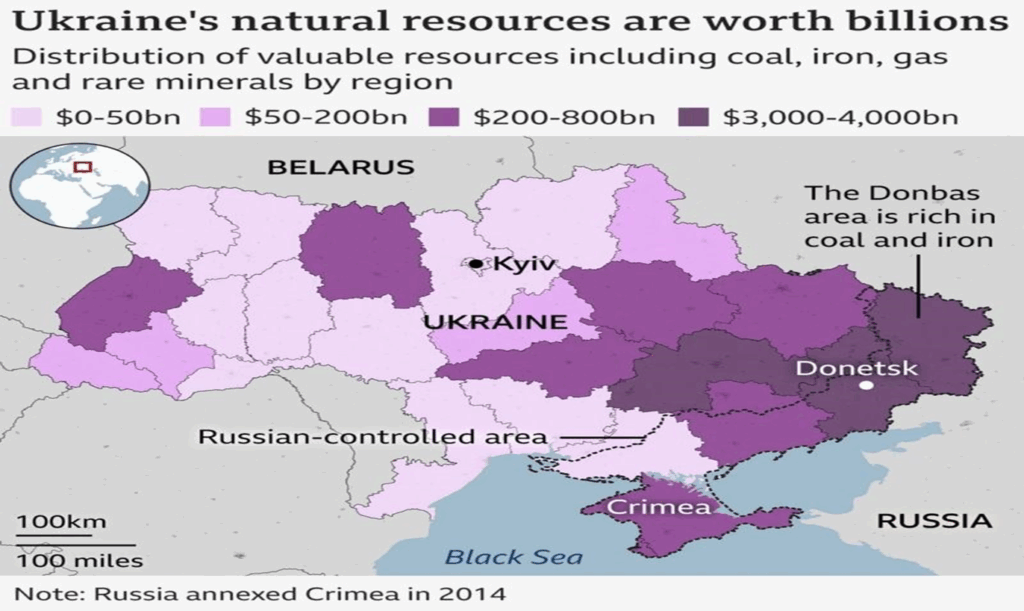

Kyiv estimates that about 5% of the world’s “critical raw materials” are in Ukraine.

This includes some 19m tonnes of proven reserves of graphite, which the Ukrainian Geological Survey state agency says makes the nation “one of the top five leading countries” for the supply of the mineral. Graphite is used to make batteries for electric vehicles

Ukraine has 7% of Europe’s supplies of titanium, a lightweight metal used in the construction of everything from aeroplanes to power stations.

Other elements found in Ukraine include beryllium and uranium, which are both crucial for nuclear weapons and reactors.

Deposits of copper, lead, zinc, silver, nickel, cobalt and manganese are also significant.

Further, Ukraine has significant deposits of rare earth metals. These are a group of 17 elements that are used to produce weapons, wind turbines, electronics and other products vital in the modern world. Some of the mineral deposits, however, have been seized by Russia.

According to Svyrydenko, resources worth $350bn (£277bn) remain in occupied territories today. In 2022, SecDev, a geopolitical risk consultancy based in Canada, established that Russia had occupied 63% of Ukrainian coal mines, as well as half of its manganese, caesium, tantalum and rare earth deposits.

Dr Robert Muggah, principal of SecDev, says that such minerals add a “strategic and economic dimension” in Russia’s continued aggression. By seizing them, he says, Moscow denies access to revenue for Ukraine, expands its own resource base and influences global supply chains.

According to Dr. Muggah, Critical minerals “are the foundation of the 21st Century economy. They are key to renewable energy, military applications and industrial infrastructure and play a growing strategic role in geopolitics and geoeconomics.

The US has been keen on a deal for Ukraine’s mineral resources because it wants to reduce dependency on China, which controls 75% of rare earth deposits in the world, according to the Geological Investment Group. In December, China banned the export of some rare earth minerals to the US, having previously limited mineral exports to the US the previous year.

Beijing then imposed more export controls on rare earth minerals as part of an escalating trade war with the US, sparked by Trump’s announcement of sweeping tariffs in April. China has now also imposed export controls on a range of critical rare earth minerals and magnets, dealing a major blow to the US.

China has a near monopoly on extracting rare earths as well as on refining them. The International Energy Agency (IEA) estimates that China accounts for about 61% of rare earth production and 92% of their processing.

That means it currently dominates the rare earths supply chain and has the capacity to decide which companies can and cannot receive supplies of rare earths. All rare earth resources also contain radioactive elements, which is why many other countries, including those in the EU, are reluctant to produce them.

Radioactive waste from production absolutely requires safe, compliant, permanent disposal. Currently all disposal facilities in EU are temporary. In response to tariffs imposed by Washington, China began ordering restrictions on the exports of seven rare earth minerals – most of which are known as “heavy” rare earths, which are crucial to the defence sector.

From 4 April, all companies now have to get special export licenses in order to send rare earths and magnets out of the country. That is because as a signatory to the international treaty on the Non-Proliferation of Nuclear Weapons, China has the ability to control the trade of “dual use products”. According to the Centre for Strategic and International Studies (CSIS), this leaves the US particularly vulnerable as there is no capacity outside China to process heavy rare earths.

A US Geological report notes that between 2020 and 2023, the US relied on China for 70% of its imports of all rare earth compounds and metals. This means that the new restrictions have the ability to hit the US hard. Heavy rare earths are used in many military fields such as missiles, radar, and permanent magnets.

A CSIS report notes that defence technologies including F-35 jets, Tomahawk missiles and Predator unmanned aerial vehicles all depend on these minerals. Prices for critical rare earth materials are expected to surge, increasing the immediate costs of components used in a wide range of products, from smartphones to military hardware.

If such a shortage from China persists in the long-run, the US could potentially begin diversifying its supply chains and scaling up its domestic and processing capabilities.

CAN’T THE AMERICA PRODUCE ITS OWN RARE EARTHS?

The US has one operational rare earths mine, but it does not have the capacity to separate heavy rare earths and has to send its ore to China for processing. There used to be US companies that manufactured rare earth magnets – until the 1980s, the US was in fact the largest producer of rare earths. Another place Trump has had his eye on is Greenland – which is endowed with the eighth largest reserves of rare earth elements.

Trump has repeatedly showed interest in taking control of the autonomous Danish dependent territory and has refused to rule out economic or military force to take control of it.

The challenge the US faces is two-fold, on the one hand it has alienated China who provides the monopoly supply of rare earths, and on the other hand it is also antagonising many nations that have previously been friendly collaborators through tariffs and other hostile actions.

UKRAINE EXPECTING INVESTMENTS

Ukraine’s Deputy Prime Minister Yulia Svyrydenko said that the fund created by the agreement would “attract global investment into our country“. Some commentators described the initial US offer as “colonial”, but Kyiv is interested in joint exploration of its resources.

According to the World Economic Forum, Ukraine has about 20,000 mineral deposits covering 116 types, but only about 15% of sites were being actively exploited at the time of Russia’s full-scale invasion in 2022.

The country’s sizeable lithium deposits are still largely untapped. Likewise, rare earth deposits are known to exist, but none of them have yet been mined, because of a lack of investment.

If Ukraine can attract US investors to help develop its natural resources, it will be highly beneficial for the country’s economy. Ukraine state is expecting technology transfer in the wake of this deal for rare earth minerals. It may help in generation of employment and revenue.

Trump has previously suggested the presence of US contractors in Ukraine would act as a security guarantee to deter Russian aggression in the future, but Ukraine and European leaders have insisted that would not be enough.

Support for Ukraine has become a key issue since Donald Trump returned to the White House.

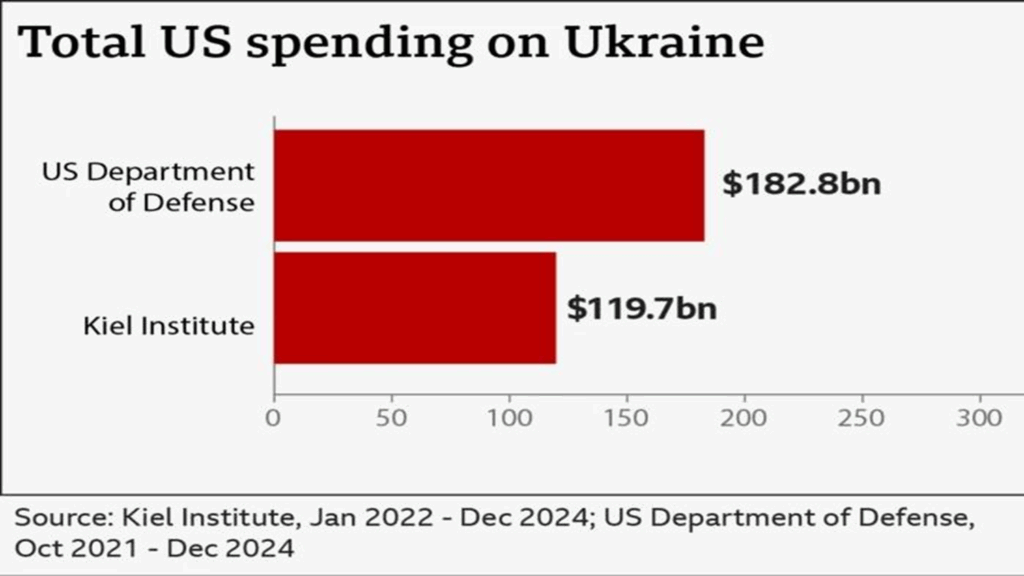

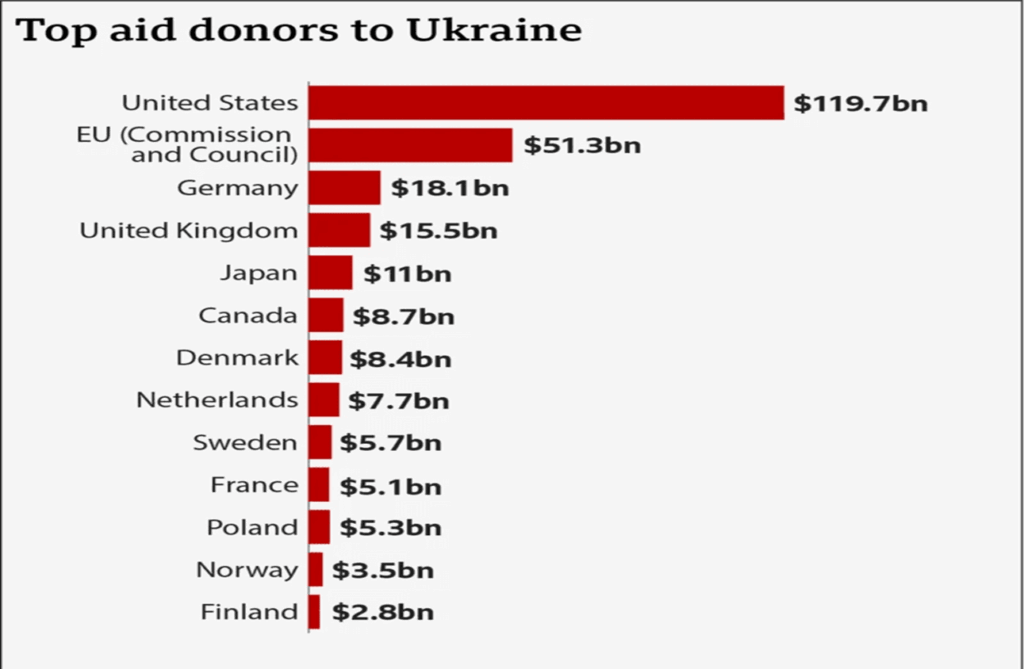

President Trump has made a number of claims about how much the United States has spent compared to European countries. But some of his claims are questionable – with no evidence to back them up – President Trump has made this claim on a number of occasions – including when he hosted France’s President Macron in the White House recently.

The US Department of Defense has provided a figure looking at all spending on Operation Atlantic Resolve – a response to Russia’s invasion of Ukraine. It says $182.8bn has been “appropriated” – a figure that covers US military training in Europe and replenishment of US defence stocks. President Trump has claimed: “We’ve spent more than $300bn and Europe has spent about $100bn – that’s a big difference” Figures suggest Europe has spent more when all aid is included and , we can’t find any evidence for the $300bn figure.

The United States is, by some margin, the largest single donor to Ukraine. But Europe combined has spent more money than the United States, according to the Kiel Institute. Between 24 January 2022 and the end of 2024, Europe as a whole spent $138.7bn on Ukraine.

In the same period, the United States spent $119.7bn, according to their figures. The European Union says EU countries have provided around $145bn in aid so far and that just 35% of that has been loans.

0 Comments